How Pet Insurance Can Be a Lifesaver. From Broken Bones to Chronic Conditions.

Max, my goofy Golden Retriever, is more than just a pet. He’s family. From the moment those big, brown eyes stole my heart as a puppy, I knew I’d do anything to keep him happy and healthy. But life throws curveballs, and a couple of years ago, Max faced one that left me scrambling.

One playful afternoon at the park turned into a frantic trip to the vet. Max had somehow managed to swallow a rogue tennis ball, requiring emergency surgery. Thankfully, he made a full recovery, but the vet bill would have left me facing a financial mountain if I wouldn’t have had my Pet Insurance.

A Good Pet Insurance Can Save You and Your Furry Friend

Pet insurance, a concept I’d vaguely considered but never fully explored, became a lifesaver. It covered a significant portion of the surgery, easing the burden and allowing me to focus on Max’s recovery.

This experience highlighted the importance of pet insurance. It’s a financial safety net that can help responsible pet owners manage unexpected vet bills, ensuring our furry companions receive the best possible care without breaking the bank.

While Max’s story has a happy ending, it serves as a reminder. Veterinary care can be expensive, and even the most playful Pet can encounter unforeseen health problems.

What is Pet Insurance?

Think of pet insurance as a type of insurance specifically designed for our furry friends. Similar to human health insurance, it helps cover veterinary expenses incurred due to accidents or illnesses.

Here’s how it works:

You pay a monthly premium like a car insurance payment. If your pet needs medical attention, you pay the vet upfront and then file a claim with your insurance company. Depending on your chosen plan, they reimburse you for a portion of the bill, typically after a deductible (the amount you pay out of pocket before insurance kicks in).

Why Should You Consider Pet Insurance?

The rising cost of veterinary care is a reality. Advancements in veterinary medicine lead to more sophisticated treatment options, but they come at a price. A simple broken bone can cost thousands to repair, and surgeries like Max’s can easily break the five-figure barrier.

A Pet insurance provides peace of mind. When faced with a health scare, you can focus on your pet’s well-being, not the financial implications of their treatment. Having a plan ensures they receive the best possible care without worrying about the cost. Additionally, it helps manage unexpected vet bills, preventing financial hardship.

Beyond Emergency Care: The Benefits of Comprehensive Coverage

While emergency coverage is crucial, some plans offer more comprehensive coverage. These plans can cover a wider range of treatments, including diagnostics, hospitalization, surgeries, and even prescription medications.

Imagine your dog developing a chronic condition like diabetes. The cost of insulin and regular vet visits can quickly add up. Pet insurance with a wellness add-on can help manage these ongoing expenses, allowing you to focus on providing your feline friend with the care they need.

Choosing the Right Pet Insurance for Your Furry Friend

With various pet insurance options available, finding the right plan for your pet can feel overwhelming. Here are some key factors to consider:

- Coverage: What does the plan cover? Accidents only, accidents and illnesses, or even wellness care?

- Reimbursement Level: What percentage of the vet bill will be reimbursed? Plans typically offer reimbursements between 50% and 80%.

- Deductible: This is the amount you pay upfront before the insurance kicks in. Deductible amounts can vary significantly, so choose one that fits your budget.

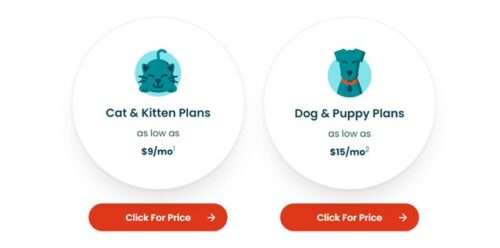

- Premium Costs: Monthly premiums can vary depending on several factors, including your pet’s age, breed, location, and the chosen coverage level.

- Pre-existing Conditions: Most pet insurance plans exclude pre-existing conditions. However, some offer coverage for pre-existing conditions after a waiting period, although it might come at a higher premium.

Remember, younger pets and certain breeds tend to have lower premiums. Always compare quotes from multiple insurers to find a plan that offers the right coverage at an affordable price.

What Isn’t Covered by Pet Insurance?

- Pre-existing Conditions: Most plans won’t cover pre-existing conditions unless specifically outlined in the policy (with waiting periods).

- Routine Care: Routine checkups, vaccinations, and spaying/neutering are typically not covered by basic plans. However, some insurers offer add-on wellness plans that cover these preventive measures.

- Cosmetic Procedures: Things like tail docking or ear cropping aren’t covered by pet insurance.

Understand the Coverage Options

Pet insurance plans come in various tiers, offering different levels of coverage. Here’s a breakdown of the main options:

- Accident-Only Plans: These offer the most basic coverage, reimbursing you for vet bills related to accidents like broken bones or swallowed objects.

- Accident and Illness Plans: This is the most popular option, covering both accidents and illnesses like cancer, diabetes, or digestive issues.

- Wellness Plans: These are add-on plans that cover preventive care, such as routine checkups, vaccinations, and spaying/neutering.

Here’s a crucial tip: Always read the fine print of your chosen pet insurance policy. Understand exclusions, waiting periods, and any limitations on coverage. Don’t hesitate to ask your insurance provider questions to ensure you fully comprehend the plan details.

Peace of Mind for You, the Best Care for Your Pet

By taking the time to research and understand pet insurance, you can invest in your pet’s well-being and your own peace of mind. Remember, it’s not about replacing your responsibility to pay for vet bills, but rather about having a financial safety net in place for unforeseen circumstances.

Max, my playful Golden Retriever, is living proof of the value of pet insurance. With a comprehensive plan in place, I can rest assured knowing he’ll receive the best possible care, no matter what life throws our way.

Don’t wait for an unexpected vet bill to scramble for financial solutions. Take charge of your pet’s future by exploring pet insurance options today. Remember, a little planning now can ensure your furry friend gets the care they deserve without breaking the bank.

Leave a Reply